In the modern digital economy, the demand for customized financial documents has led to the increasing use of tools such as a bank statement maker. This software or online platform allows users to create digital versions of bank statements that resemble the official documents issued by financial institutions. At first glance, a bank statement maker can seem like a convenient solution for businesses, developers, and individuals who need sample financial records. However, its use walks a fine line between practicality and potential misuse, making it essential to understand its proper applications and the risks involved.

A bank statement maker is commonly used in professional environments where mock financial data is required. For instance, software developers working on financial applications often need realistic sample data to test features like balance tracking, expense categorization, or income analysis. In such scenarios, real customer data cannot be used due to privacy laws and data protection regulations, making generated statements a safe and effective alternative. Similarly, educators and trainers in finance-related fields may use these tools to simulate real-world scenarios without risking sensitive information exposure.

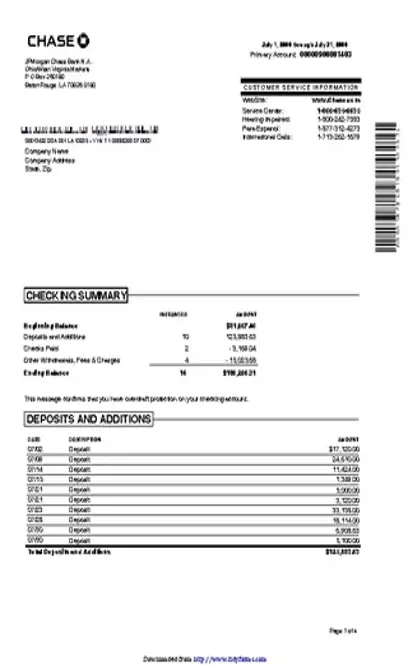

Despite these valid applications, the misuse of a bank statement maker for dishonest purposes is a growing concern. Some individuals use these tools to create fake financial documents intended to deceive others. This might involve inflating bank balances, fabricating transaction histories, or editing details to misrepresent one’s financial situation. Whether it’s to secure a loan, rent an apartment, or apply for credit, presenting a forged statement crosses into fraudulent activity. Such actions not only violate ethical norms but are also punishable under law in most jurisdictions.

The legal implications of misusing a bank statement maker are serious. Producing and submitting false documentation to obtain financial or personal benefits is considered fraud. Authorities treat such offenses with significant penalties, ranging from fines and repayment of ill-gotten gains to imprisonment. The digital nature of these tools also means that traces of document creation can often be tracked, leaving a trail of evidence that undermines the user’s defense. In a digital world where everything leaves a footprint, such acts rarely go unnoticed.

Financial institutions are increasingly aware of the sophistication of fake documents generated by these tools. Many banks have implemented more robust document verification systems, including cross-referencing statements with internal records or using digital watermarking to ensure authenticity. As the tools become more advanced, so too do the methods of detecting their misuse.

Ultimately, while a bank statement maker can serve legitimate, even beneficial purposes in education, business development, or training, it must be used responsibly. The temptation to use it for fraudulent activities can lead to severe consequences, both legally and professionally. Trust remains the cornerstone of financial transactions, and violating that trust by submitting falsified documents damages not only individual credibility but also the integrity of financial systems. Responsible use, transparency, and ethical behavior are essential when engaging with such digital tools in any capacity.